About the Agent

The Deal Due Diligence Assistant modernizes M&A and investment workflows by consolidating and interpreting massive document sets with high accuracy. It identifies obligations, liabilities, inconsistencies, unusual clauses, operational risks, compliance gaps, revenue anomalies, and people-related issues.

Instead of reading hundreds or thousands of pages manually, deal teams receive actionable summaries, red-flag lists, and decision-support briefs that accelerate evaluation and reduce risk.

Private equity firms, investment bankers, corporate strategy teams, legal advisors, and venture funds use this agent to streamline pre-deal analysis and enhance deal confidence.

Problem Statement

During mergers, acquisitions, partnerships, and investment evaluations, teams must review massive amounts of deal documents—financial reports, contracts, compliance statements, operational summaries, legal disclosures, and risk reports.

The traditional due-diligence process is:

Slow and highly manual

Prone to oversight or incomplete analysis

Dependent on subject-matter experts

Difficult to scale across multiple deals

Burdened by document complexity and volume

Missed risks, overlooked liabilities, or incomplete reviews can lead to poor investment decisions, valuation errors, and costly post-deal surprises.

💡 Overview

The Deal Due Diligence Assistant by Codersarts AI automates the extraction, summarization, and analysis of deal documents—highlighting key risks, obligations, opportunities, red flags, and decision-critical insights.

The agent reviews:

Contracts & agreements

Financial statements

Compliance & regulatory documents

Organizational charts & HR files

Litigation history

Operational reports

Risk assessments

NDAs, term sheets, and LOIs

Using AI-powered document intelligence, financial reasoning, clause analysis, and risk scoring, it produces clear summaries and due-diligence insights in minutes.

📊 Detailed Breakdown

Section | Details |

Who It’s For | Private Equity Firms, Venture Capital, M&A Teams, Investment Banks, Corporate Strategy, Legal Advisors, Consultants, Compliance Teams |

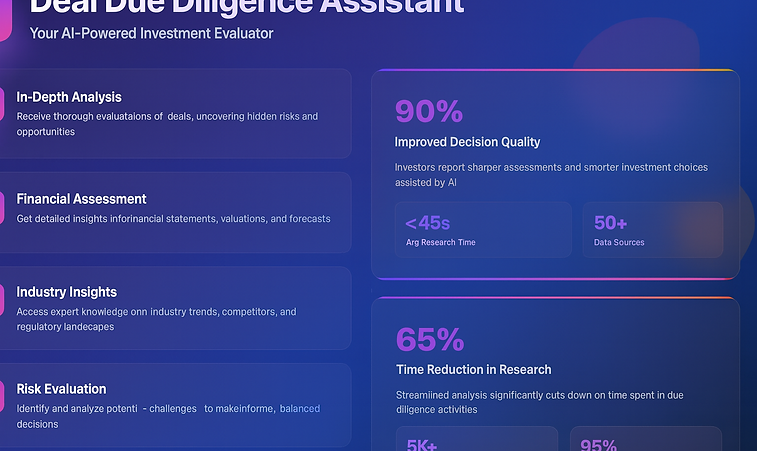

Business Results | • 70–85% reduction in document review time • Faster deal evaluation cycles • More accurate identification of risks & liabilities • Stronger confidence in go/no-go decisions |

Workflow Summary | 1️⃣ Document Collection: Upload contracts, financials, compliance files, and organizational docs. 2️⃣ AI Analysis: Extracts key clauses, metrics, anomalies, and structural insights. 3️⃣ Summarization: Produces executive summaries, risk lists, and insights by category. 4️⃣ Reporting: Generates investor-friendly due-diligence reports. |

Performance Metrics | ⚡ 5× faster deal review 📊 90%+ accurate risk detection 🔍 Clear categorization of liabilities & obligations 📁 Audit-ready, organized due-diligence documentation |

Industry Example | 💼 PE firms reviewing acquisition targets. 🏦 Investment banks conducting buy-side due diligence. 🚀 VC firms summarizing startup data rooms. 🏢 Corporates assessing joint ventures or partnership agreements. |

Integrations & APIs | 🔗 DMS: Dropbox, Drive, SharePoint 🔗 Deal Room Platforms: Datasite, Intralinks, FirmRoom 🔗 AI Tools: GPT Models, LangChain, OCR 🔗 Databases: Financial APIs, Clause Libraries, Compliance Databases |

📈 Key Highlights

Metric | Result |

📘 Summaries | Clear, structured insights for decision-makers |

🛡 Risk | Automatic detection of liabilities and red flags |

⚙️ Efficiency | Faster pre-deal evaluation with fewer resources |

🔍 Accuracy | Semantic understanding of financial & legal nuances |

🌍 Industry Impact

“AI-powered due diligence dramatically reduces deal risk by surfacing insights and red flags that would otherwise require hours of expert manual review.”

This agent is used in:

Early-stage opportunity screening

Full-scale pre-deal diligence

Legal & compliance reviews

Financial and operational assessments

Partner/vendor evaluations

It accelerates decisions, reduces workload on analysts, and improves the quality of every deal review.

💬 Client or Industry Quote

“Codersarts’ Due Diligence Assistant allowed us to analyze an entire deal room in hours instead of days. We caught risks that typically surface only in late-stage negotiation.”— Managing Director, Private Equity Fund

🚀 Accelerate Deal Evaluation with Codersarts AI

Codersarts AI helps deal teams review documents, identify risks, and generate investor-ready summaries with unmatched speed and accuracy.

📩 Email: contact@codersarts.com

💬 Request a Demo: https://ai.codersarts.com/contact

Primary Keywords: AI Due Diligence Tool, Deal Document Summarizer, M&A Automation, Investment Analysis AI, Codersarts AI

The Deal Due Diligence Assistant summarizes large deal documents, highlights risks, and delivers decision-ready insights for M&A, PE, and VC teams.

AI Agent that reviews deal documents, identifies key risks, and produces concise due-diligence summaries.

🧱 Stay Tuned — More Resources Coming Soon

We’re preparing additional resources to enhance your understanding of deal automation:

🎥 Explainer Video: “AI for Deal Due Diligence”

📘 Case Study: “Accelerating M&A Decision Cycles with AI”

🔗 Related Agents: Contract Comparison Agent, Risk Scoring Agent, Compliance Checker Agent

🧩 Blog: “How AI is Transforming M&A and Investment Operations”

These will be added shortly — stay tuned!

🔧 Tech Stack Snapshot

Frameworks: Python, FastAPI, LangChain

AI Models: GPT-4/5, Document Summarizers, Risk Scoring Models

Databases: PostgreSQL, MongoDB, Vector Databases

Integrations: Dataroom platforms, SharePoint, financial data APIs

Deployment: Cloud-native with enterprise security options